Benjamin accompanying a marine underwriter at a shipyard visit

Yes, it was. Both the Maritime and Insurance industries rely heavily on acronyms and combining the two was certainly daunting. Aside from picking up insurance terminology, I had to understand shipping terminology such as demurrage, CPA etc. and even until today, I am still picking things up, as change is constant in shipping. To overcome this, I would borrow books on shipping and read them during my spare time, which gave me an understanding of the business and what we are trying to insure for our clients.

However, I was not alone, and the maritime community was welcoming. The initial years may be a bit of a struggle, but it is not always an upward curve as once you are familiar with the industry and with the support of the community, you will gain confidence over time. This is also where the fun comes in as you can structure and design solutions which creatively addresses clients’ needs.

Generally, people enter marine insurance via either underwriting or broking. Each has its own appeal, and the beauty of this industry is it allows for crossovers. You can begin your career as an underwriter and subsequently move over into broking because there are common set of transferable skills. Brokers at a junior level will initially be involved in documentation, processing of invoices, claims administration and gradually progress on to negotiating with underwriters and eventually interacting with clients.

For the more reserved personalities, underwriting may be more suitable. That said, I know of a few successful marine brokers who are thriving despite their introverted personalities

There is a growing trend among our clients especially the larger ones where they have their own in-house marine insurance department, and this represents yet another viable option for marine insurance professionals to consider

We are intermediaries acting on behalf of our clients (e.g. Shipowners, ports & shipyards and commodity traders) by tapping on both our expert knowledge of marine insurance as well as our existing network of underwriters, surveyors, adjusters and lawyers to identify the best available appropriate insurances or solutions at appropriate levels at a reasonable price.

Unlike other intermediaries in the maritime industry, our job does not end upon sealing the deal, as it is an ongoing service commitment usually over a period of 12 months where we produce documentation, contractual changes and claims handling.

Brokers are also expected to be the client’s advocate particularly during difficult scenarios such as a navigating through a complex claim. Because we represent both the client and the insurance company, we also help to mediate between the two parties to achieve a balanced outcome for all parties involved.

Given our service-oriented and client facing duties, reputational risk is of significant importance to us and as a Director, I am responsible for running due diligence and ensuring the team and I conducts ourselves to the highest degree of professionalism and excellence expected of us to ensure our organisation’s reputation is never compromised. In addition, I am also responsible for business development and marine strategy within the region.

Integrity, effective communication and a good imagination.

Integrity is paramount as its one of the main principles of insurance. As an intermediary, we are privy to information on both the Insurer and the Insured.

As marine insurance contracts can often seem mystifying and complex especially to the uninitiated, we have to be able to articulate across the conditions to ensure clients are fully aware of the scope of coverage including any subjectivities, warranties and exclusions.

People are often surprised when I mention imagination. Having a good imagination allows you to consider all probable scenarios to ensure we secure the appropriate coverage relevant to our client’s needs. To cite an example, a few years before the pandemic we were trying to develop a standalone insurance coverage for any associated costs arising from outbreak of infectious diseases both on board vessels and ashore. Now with Covid-19, this seems obvious but back then everyone was sceptical.

Today’s conversation is revolving around growing cyber exposures and sustainability trends in shipping and we are currently working on a few potential solutions to ensure our clients are well prepared

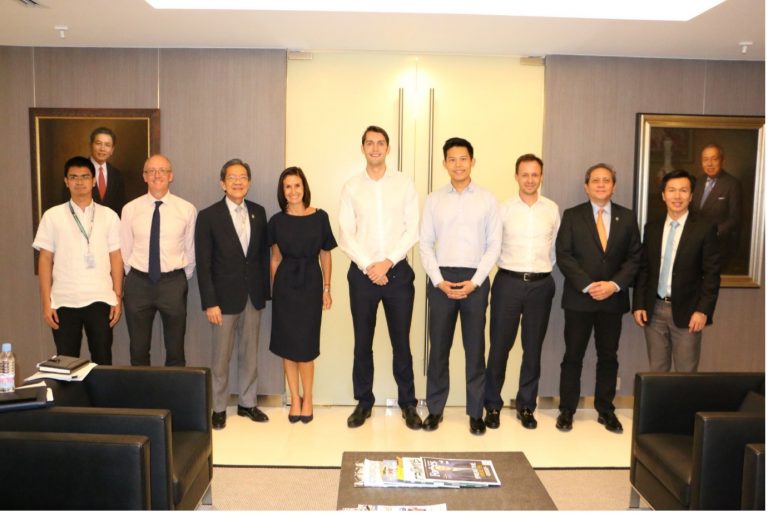

Benjamin visiting a client in Manila

I think outsiders will be surprised to realise how close-knit the industry with a strong sense of belonging. The community is warm and approachable, and we are always excited to welcome newcomers and share our knowledge.

Given maritime has been around for a long time, some of our methodology especially on underwriting of risks may appear archaic to outsiders but the situation is evolving rapidly in the last few years

The industry is also inclusive, and we are ahead of other industries on the topic of gender equality with several women in leadership positions both in broking and underwriting within marine insurance. For the young talent, I believe the ability to excel regardless of your gender is a big selling point

Very much so. Digitalisation and the advent of the internet has significantly shortened the duration needed to pick up initial basic broking skills especially those centred on processing and administration. I suppose for the veterans that come from an earlier era, there is definitely a widely held opinion that today’s crop of brokers need to earn their stripes in the same manner as they did over a protracted period. That said I do feel there are merits to the traditional way especially in face-to-face interactions. For example, before the pandemic we would encourage junior brokers to print out documents relating to contract changes and physically visit the Underwriters at their offices to obtain their sign-off. While some of these changes can easily be done over email i.e. a change in ship name, these visitations often allow junior brokers the opportunity to build up rapport with underwriters which is important as ours is a relationship-based business

Very much so. Digitalisation and the advent of the internet has significantly shortened the duration needed to pick up initial basic broking skills especially those centred on processing and administration. I suppose for the veterans that come from an earlier era, there is definitely a widely held opinion that today’s crop of brokers need to earn their stripes in the same manner as they did over a protracted period. That said I do feel there are merits to the traditional way especially in face-to-face interactions. For example, before the pandemic we would encourage junior brokers to print out documents relating to contract changes and physically visit the Underwriters at their offices to obtain their sign-off. While some of these changes can easily be done over email i.e. a change in ship name, these visitations often allow junior brokers the opportunity to build up rapport with underwriters which is important as ours is a relationship-based business

In the earlier years of my broking career, a client instructed me to bind a policy on the same day and a few hours later called to inform me that there has been an incident on this policy. This caused a bit of panic as while I had informed insurers of the client’s instructions, the incident meant the risk had deteriorated and underwriters were at liberty not to bind the policy nor pay the claim. I had to explain the situation in including sequence of events in detail to the underwriters who were fortunately sympathetic and agreed to bind the cover and honour the claim. This case was memorable for all the wrong reasons and taught me that in marine, things are always on the move and incidents can happen anytime anywhere

Always be inquisitive and keep your chin up despite any setbacks, this is a business that requires resilience and a positive mind set. In doing so, you will not only be able to build a rewarding sustainable career but also grow personally and forge meaningful relationships that follow you for life.